How Feie Calculator can Save You Time, Stress, and Money.

Wiki Article

7 Easy Facts About Feie Calculator Explained

Table of ContentsMore About Feie CalculatorThe Best Strategy To Use For Feie CalculatorThe Main Principles Of Feie Calculator 7 Simple Techniques For Feie CalculatorMore About Feie Calculator

He sold his United state home to develop his intent to live abroad permanently and used for a Mexican residency visa with his other half to assist meet the Bona Fide Residency Examination. Neil points out that getting residential or commercial property abroad can be testing without very first experiencing the place."It's something that people require to be actually attentive concerning," he claims, and suggests deportees to be cautious of common blunders, such as overstaying in the United state

Neil is careful to cautious to U.S. tax united state that "I'm not conducting any business in Company. The U.S. is one of the few countries that tax obligations its residents regardless of where they live, indicating that even if an expat has no earnings from United state

tax return. "The Foreign Tax obligation Credit rating enables people working in high-tax nations like the UK to offset their United state tax obligation obligation by the quantity they have actually currently paid in tax obligations abroad," states Lewis.

5 Easy Facts About Feie Calculator Described

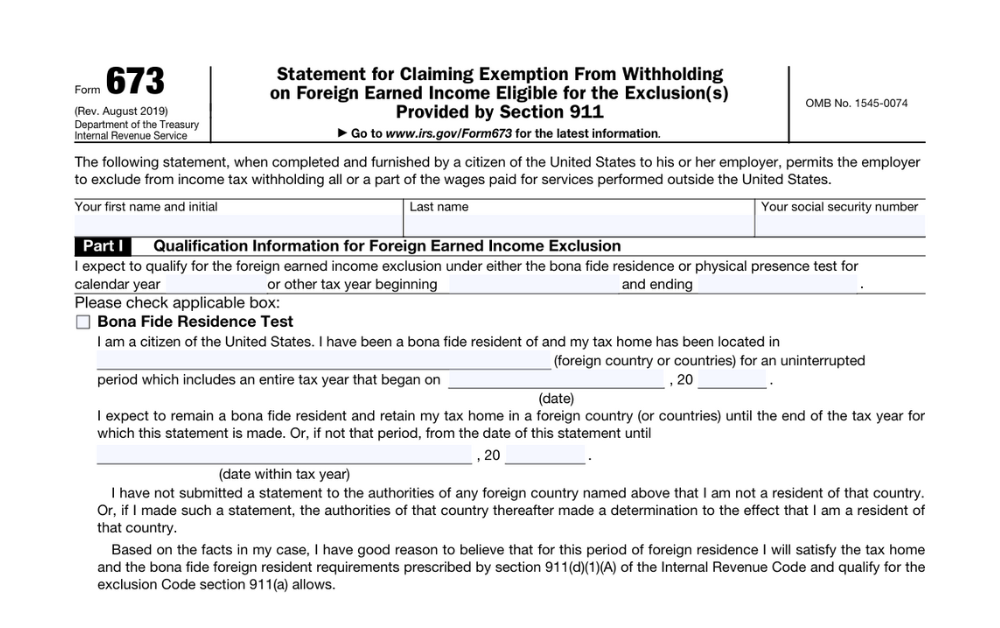

Below are some of the most regularly asked questions about the FEIE and other exemptions The International Earned Income Exclusion (FEIE) enables U.S. taxpayers to omit up to $130,000 of foreign-earned income from federal earnings tax, lowering their united state tax obligation liability. To receive FEIE, you must satisfy either the Physical Existence Examination (330 days abroad) or the Authentic House Examination (confirm your key residence in a foreign country for an entire tax obligation year).

The Physical Presence Test likewise needs U.S (Bona Fide Residency Test for FEIE). taxpayers to have both an international earnings and a foreign tax obligation home.

Little Known Facts About Feie Calculator.

A revenue tax treaty in between the U.S. and one more nation can assist visit prevent dual taxation. While the Foreign Earned Earnings Exemption minimizes taxable earnings, a treaty might supply fringe benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a required declare united state people with over $10,000 in foreign economic accounts.Eligibility for FEIE depends on meeting specific residency or physical existence tests. He has over thirty years of experience and currently specializes in CFO solutions, equity settlement, copyright taxes, cannabis taxation and separation associated tax/financial planning matters. He is a deportee based in Mexico.

The foreign gained earnings exemptions, often referred to as the Sec. 911 exemptions, exclude tax on wages gained from working abroad.

More About Feie Calculator

The earnings exemption is currently indexed for inflation. The maximum yearly income exclusion is $130,000 for 2025. The tax obligation benefit excludes the earnings from tax obligation at lower tax rates. Previously, the exclusions "came off the top" reducing revenue subject to tax obligation at the top tax rates. The exemptions might or may not lower earnings made use of for various other objectives, such as individual retirement account limitations, youngster credit reports, individual exemptions, and so on.These exclusions do not spare the wages from US taxation however simply give a tax reduction. Note that a bachelor functioning abroad for every one of 2025 who earned about $145,000 with no various other revenue will certainly have taxed earnings decreased to no - successfully the exact same answer as being "tax totally free." The exemptions are calculated each day.

Report this wiki page